NCERT Solutions Class 11 Accountancy Chapter 4 Recording of Transactions II – Here are all the NCERT solutions for Class 11 Accountancy Chapter 4. This solution contains questions, answers, images, explanations of the complete chapter 4 titled Recording of Transactions II of Accountancy taught in Class 11. If you are a student of Class 11 who is using NCERT Textbook to study Accountancy, then you must come across chapter 4 Recording of Transactions II. After you have studied lesson, you must be looking for answers of its questions. Here you can get complete NCERT Solutions for Class 11 Accountancy Chapter 4 Recording of Transactions II in one place.

NCERT Solutions Class 11 Accountancy Chapter 4 Recording of Transactions-II

Here on AglaSem Schools, you can access to NCERT Book Solutions in free pdf for Accountancy for Class 11 so that you can refer them as and when required. The NCERT Solutions to the questions after every unit of NCERT textbooks aimed at helping students solving difficult questions.

For a better understanding of this chapter, you should also see summary of Chapter 4 Recording of Transactions-II , Accountancy, Class 11.

| Class | 11 |

| Subject | Accountancy |

| Book | Financial Accounting Part 1 |

| Chapter Number | 4 |

| Chapter Name |

Recording of Transactions-II |

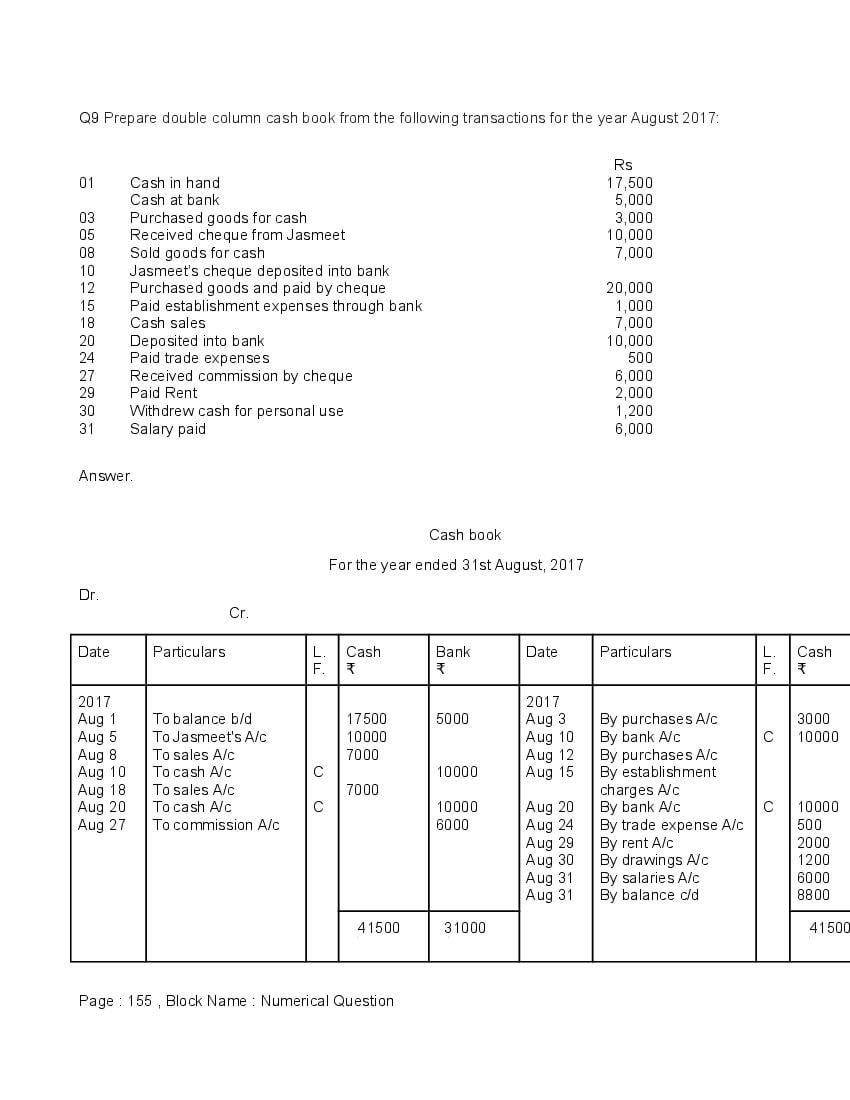

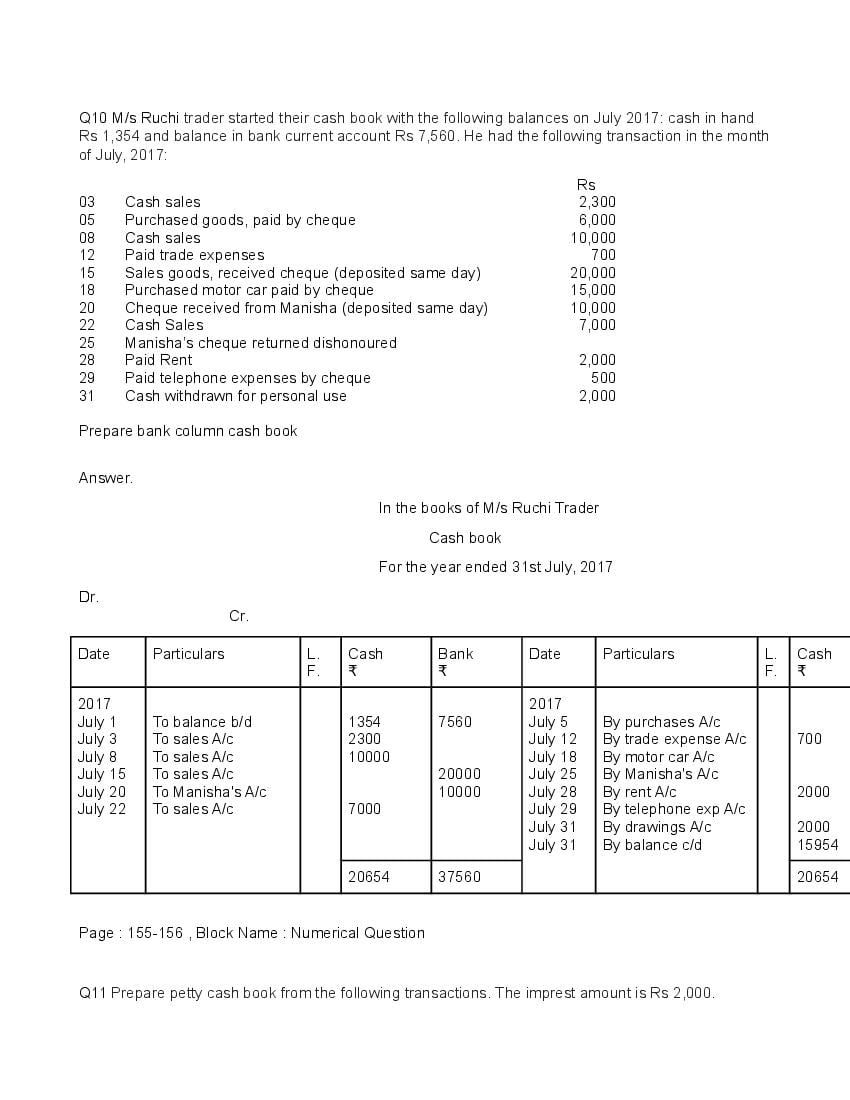

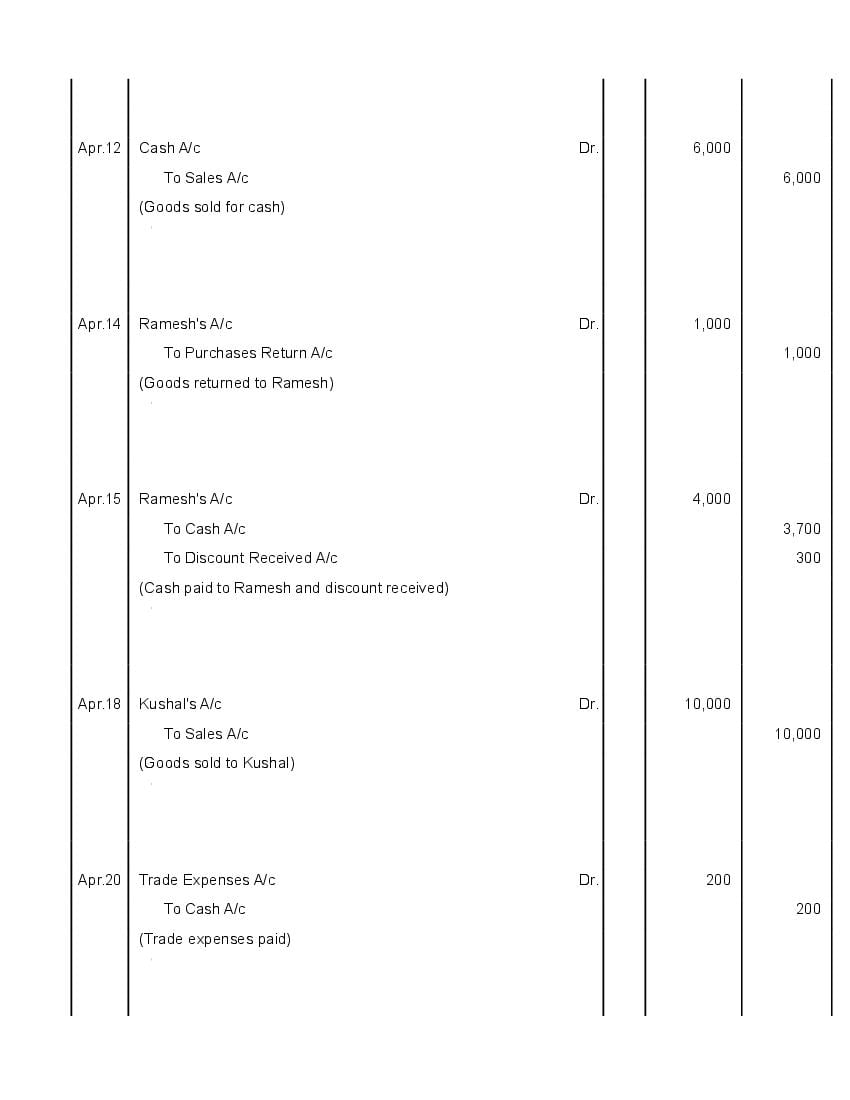

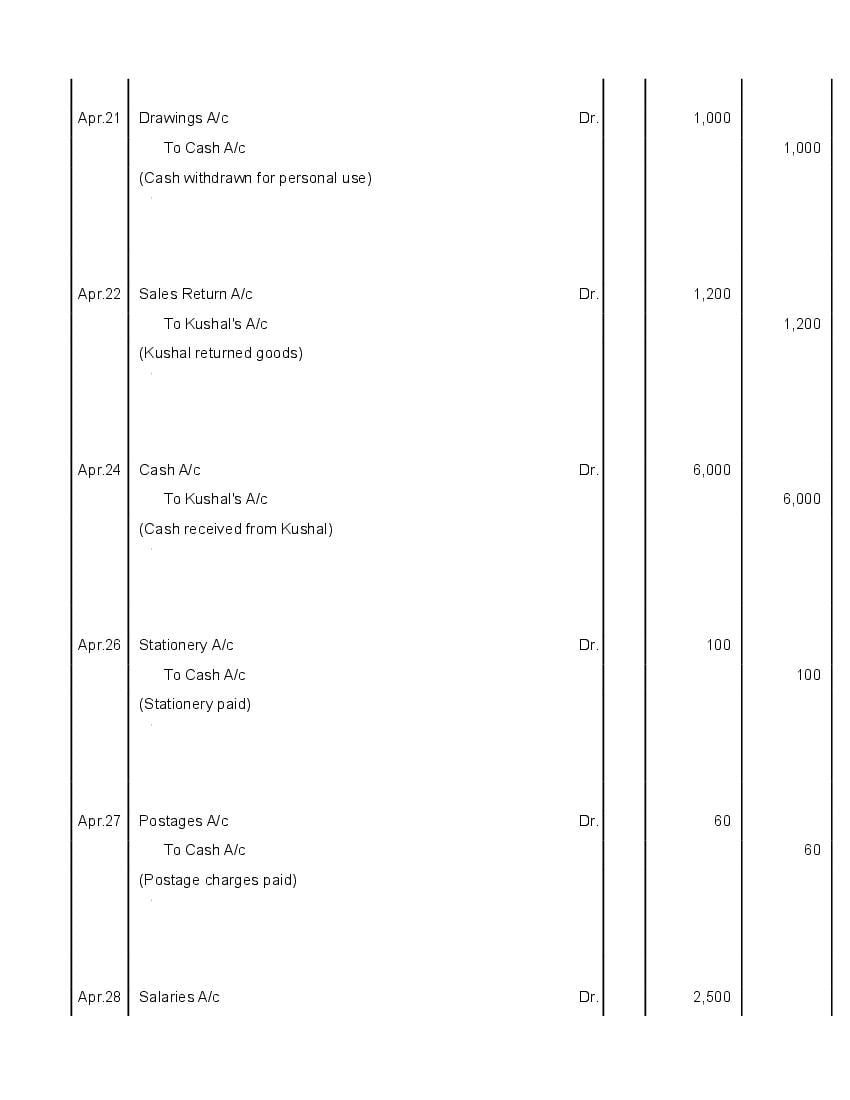

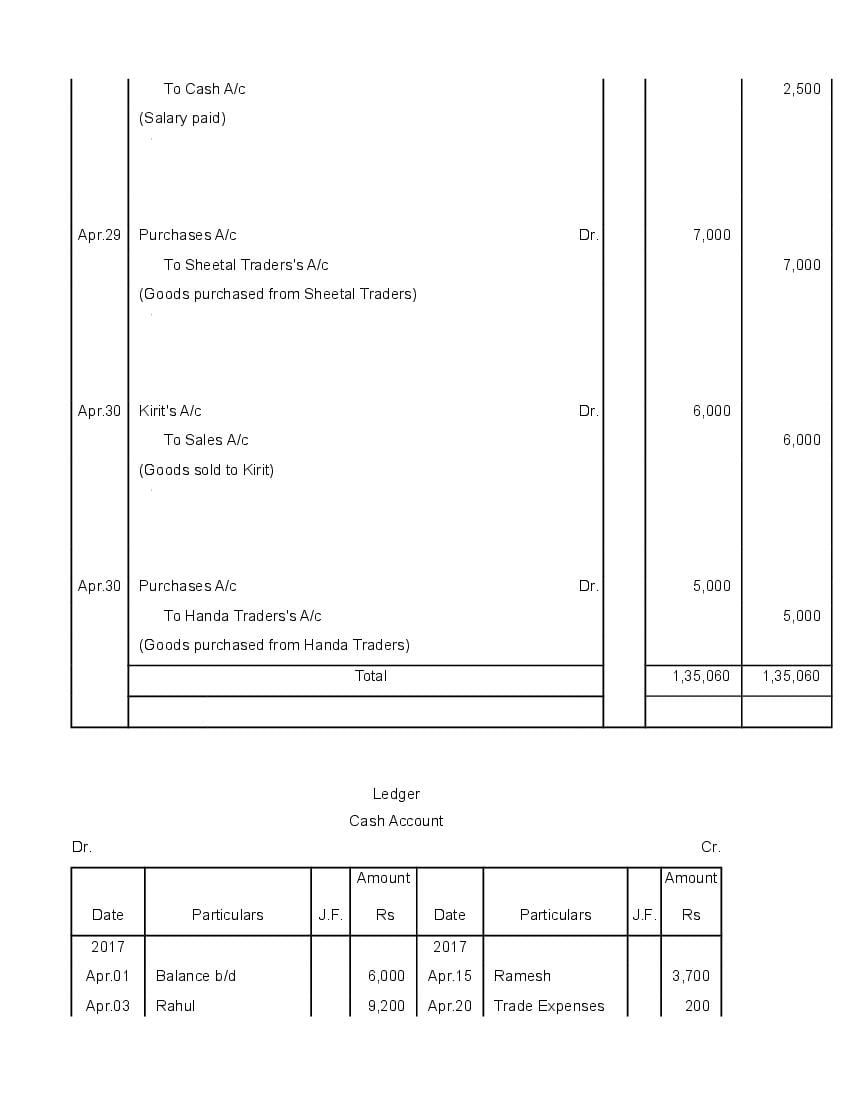

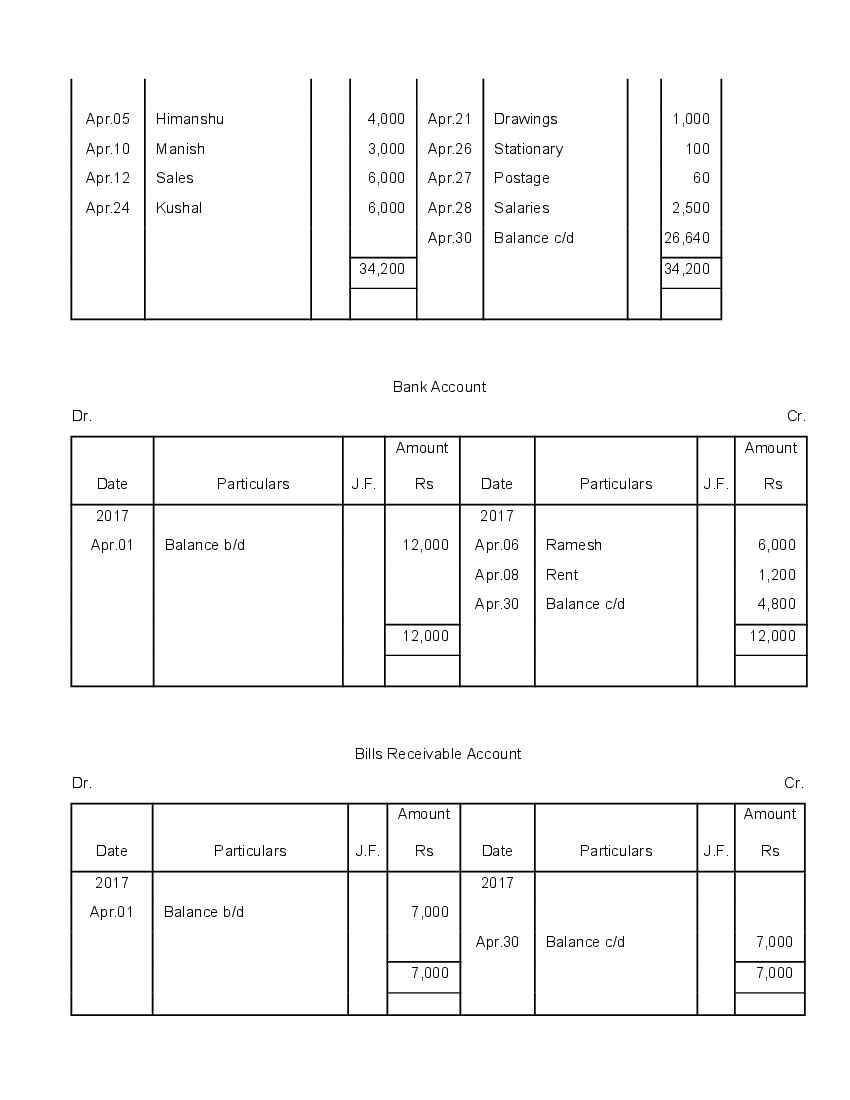

NCERT Solutions Class 11 Accountancy chapter 4 Recording of Transactions-II

Class 11, Accountancy chapter 4, Recording of Transactions-II solutions are given below in PDF format. You can view them online or download PDF file for future use.

Recording of Transactions-II Download

Did you find NCERT Solutions Class 11 Accountancy chapter 4 Recording of Transactions-II helpful? If yes, please comment below. Also please like, and share it with your friends!

NCERT Solutions Class 11 Accountancy chapter 4 Recording of Transactions-II- Video

You can also watch the video solutions of NCERT Class11 Accountancy chapter 4 Recording of Transactions-II here.

Video – will be available soon.

If you liked the video, please subscribe to our YouTube channel so that you can get more such interesting and useful study resources.

Download NCERT Solutions Class 11 Accountancy chapter 4 Recording of Transactions-II In PDF Format

You can also download here the NCERT Solutions Class 11 Accountancy chapter 4 Recording of Transactions-II in PDF format.

Click Here to download NCERT Solutions for Class 11 Accountancy chapter 4 Recording of Transactions-II

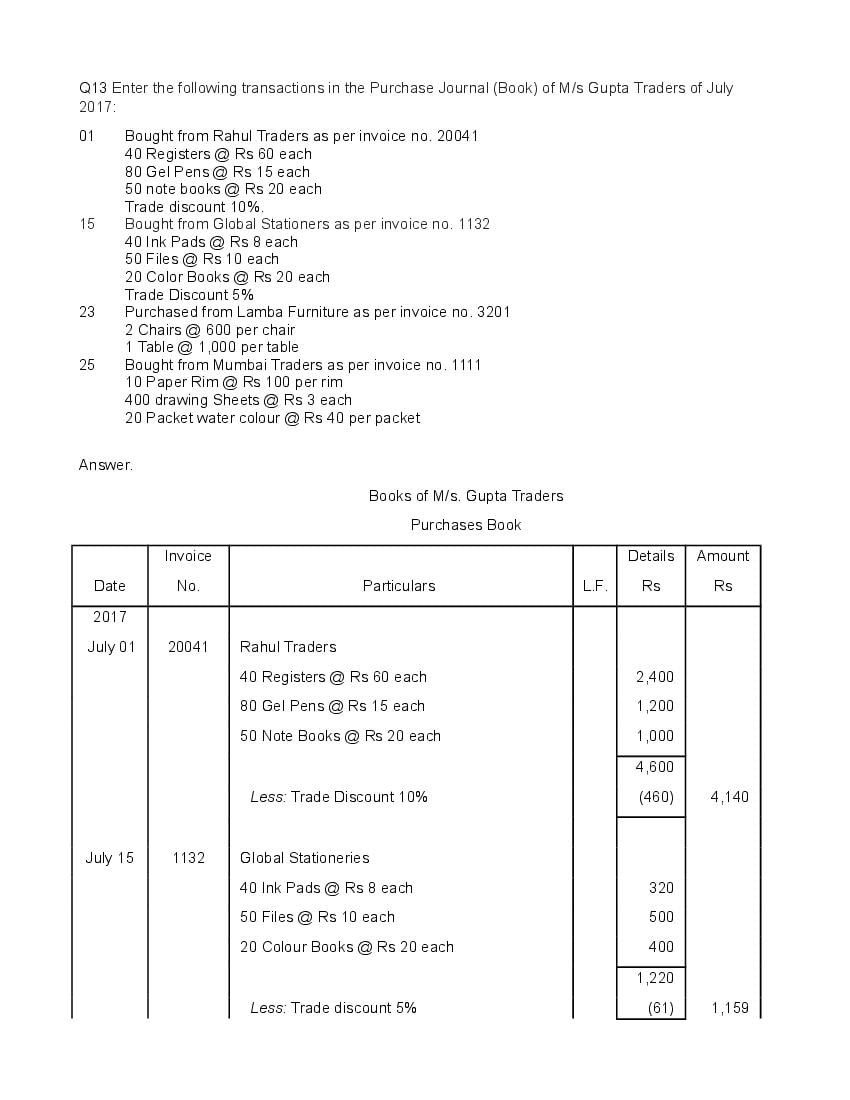

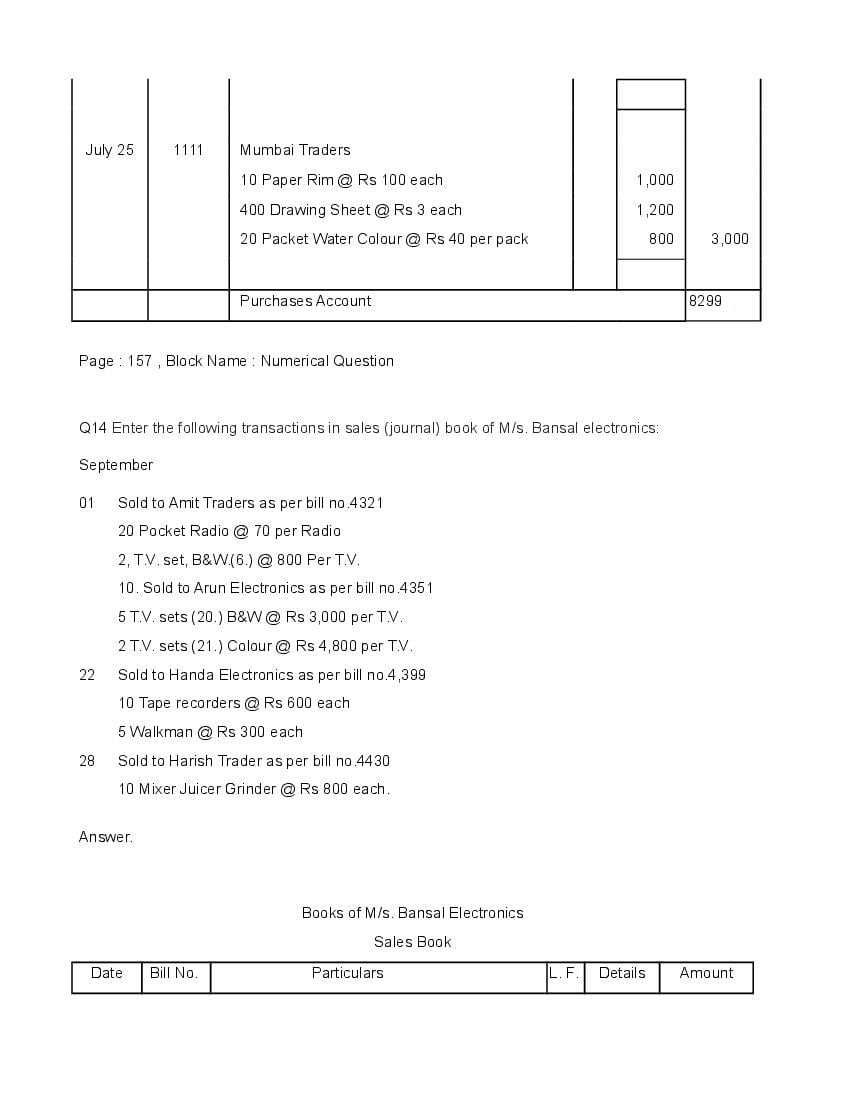

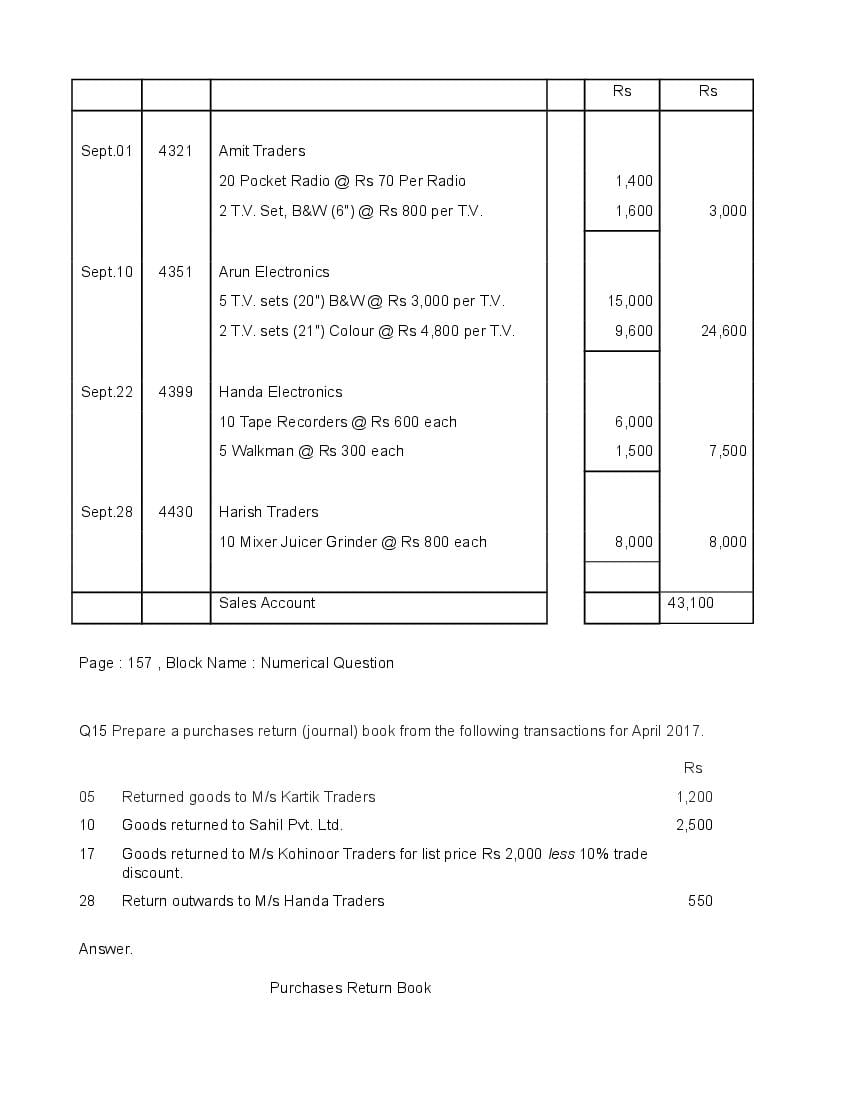

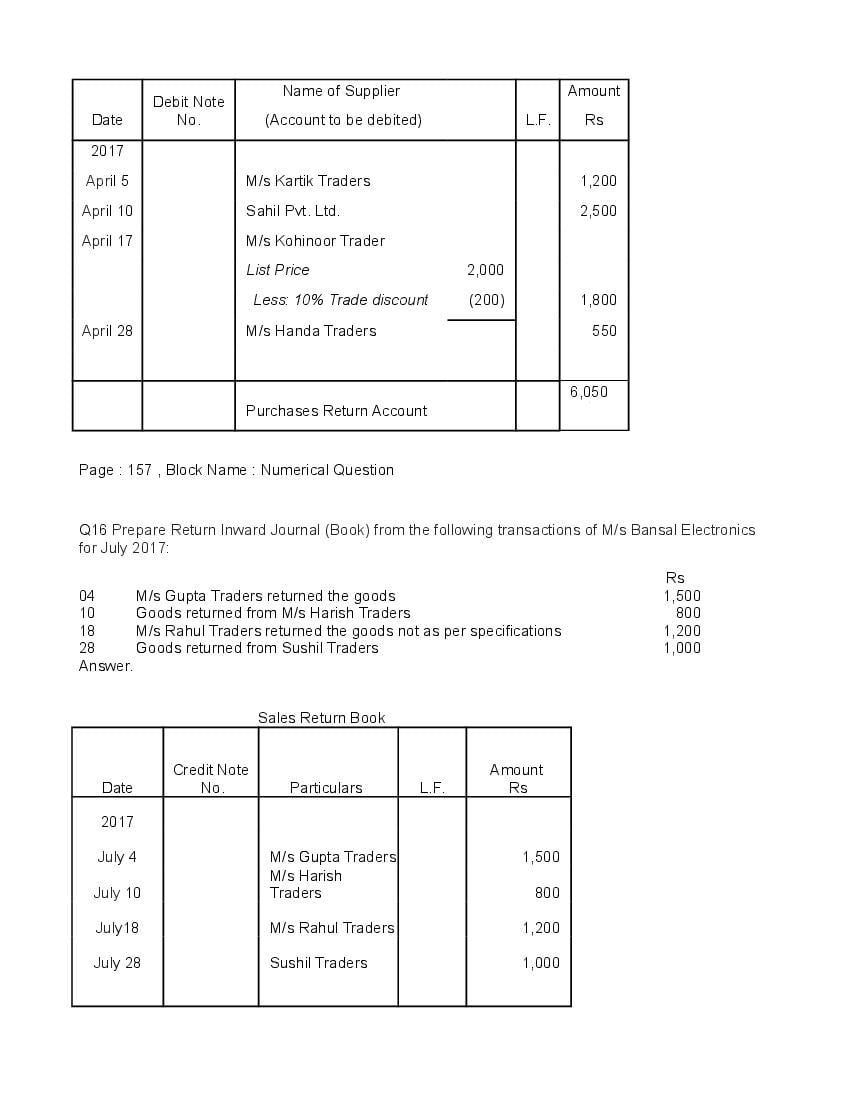

Question & Answer

Q.1: Briefly state how the cash book is both journal and a ledger.

Ans : Transactions are recorded directly from source documents in the Cash Book. so there is no need to record transactions in the Journal book. Further. on the basis of the cash transactions recorded in the Cash Book. cash and bank balances can be determined. and so there is no need to prepare cash account (which is a part of ledger) separately. Thus, the Cash Book serves the purpose of both Journal as well as ledger.

Q.2: What is the purpose of contra entry?

Ans : Contra entry represents deposits or withdrawals of cash from bank or vice versa. The purpose of contra entry is to indicate the transactions that effect both cash and bank balances. This entry does not affect the financial positions of a business. A contra entry is recorded in both sides of a two column Cash Book and is denoted by 'C' in the ledger folio

Q.3: What are special purpose books?

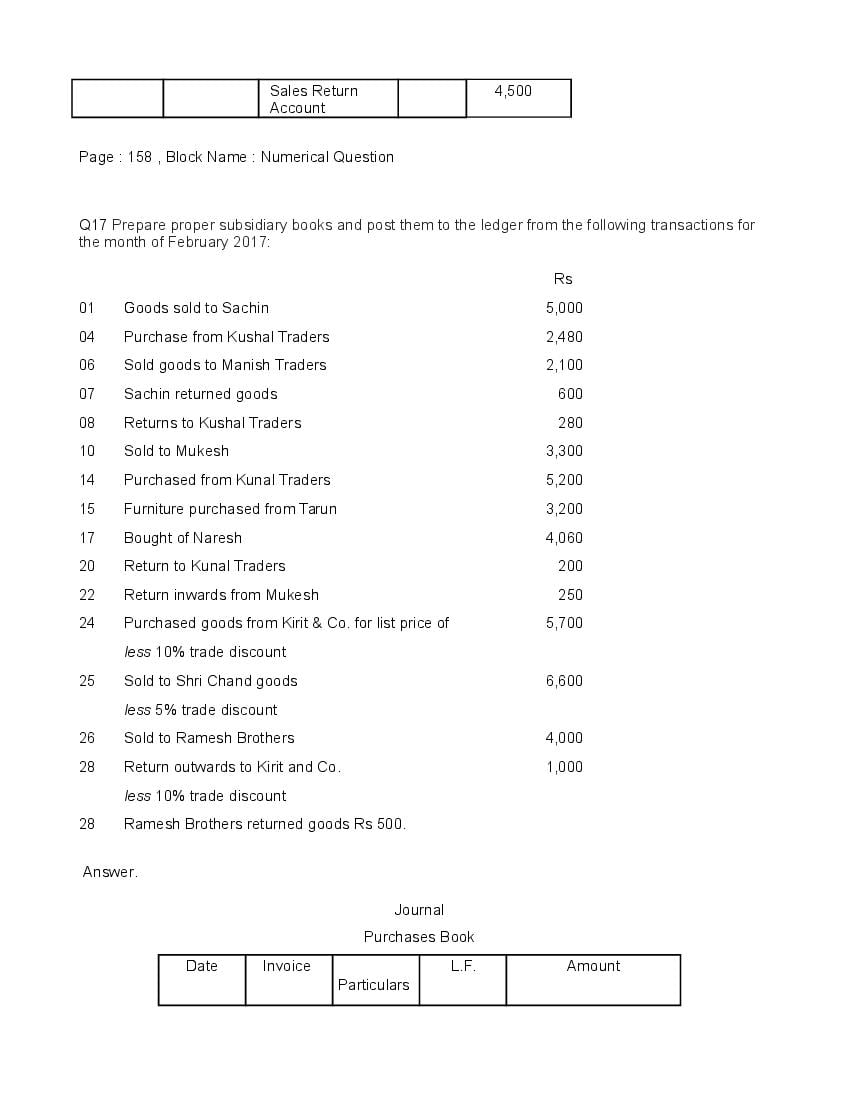

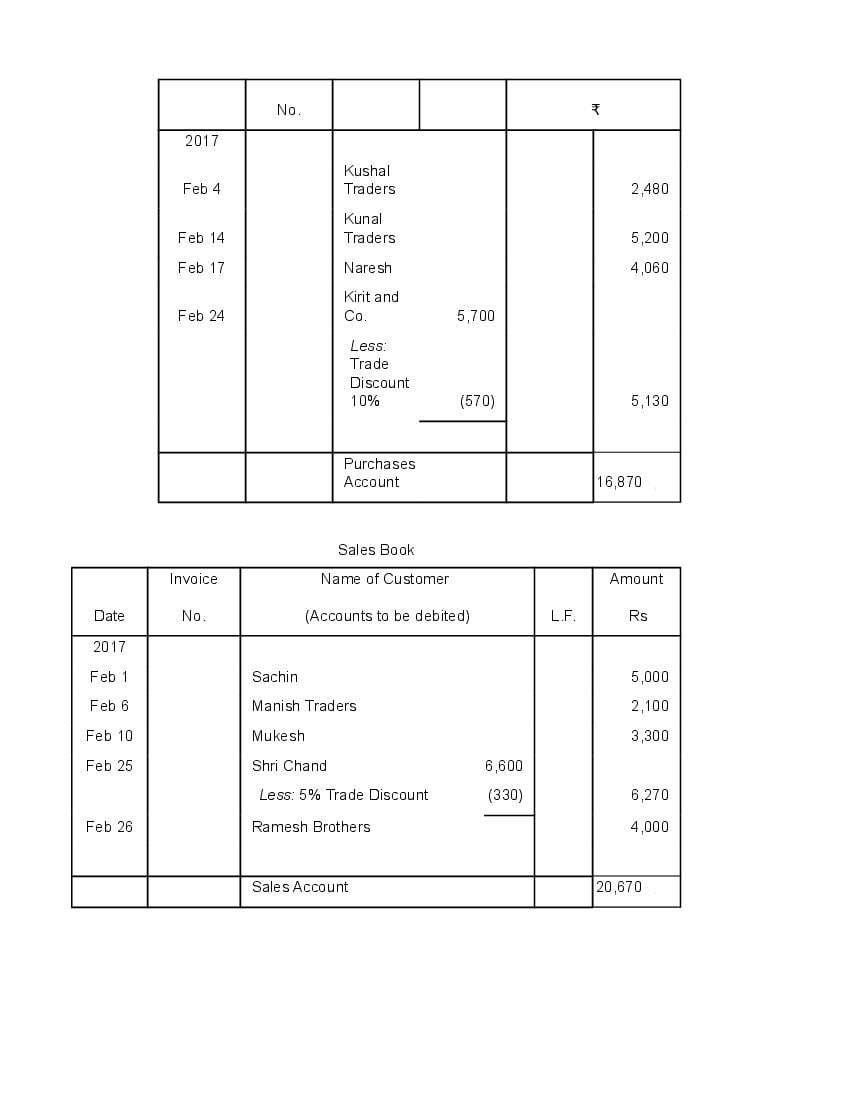

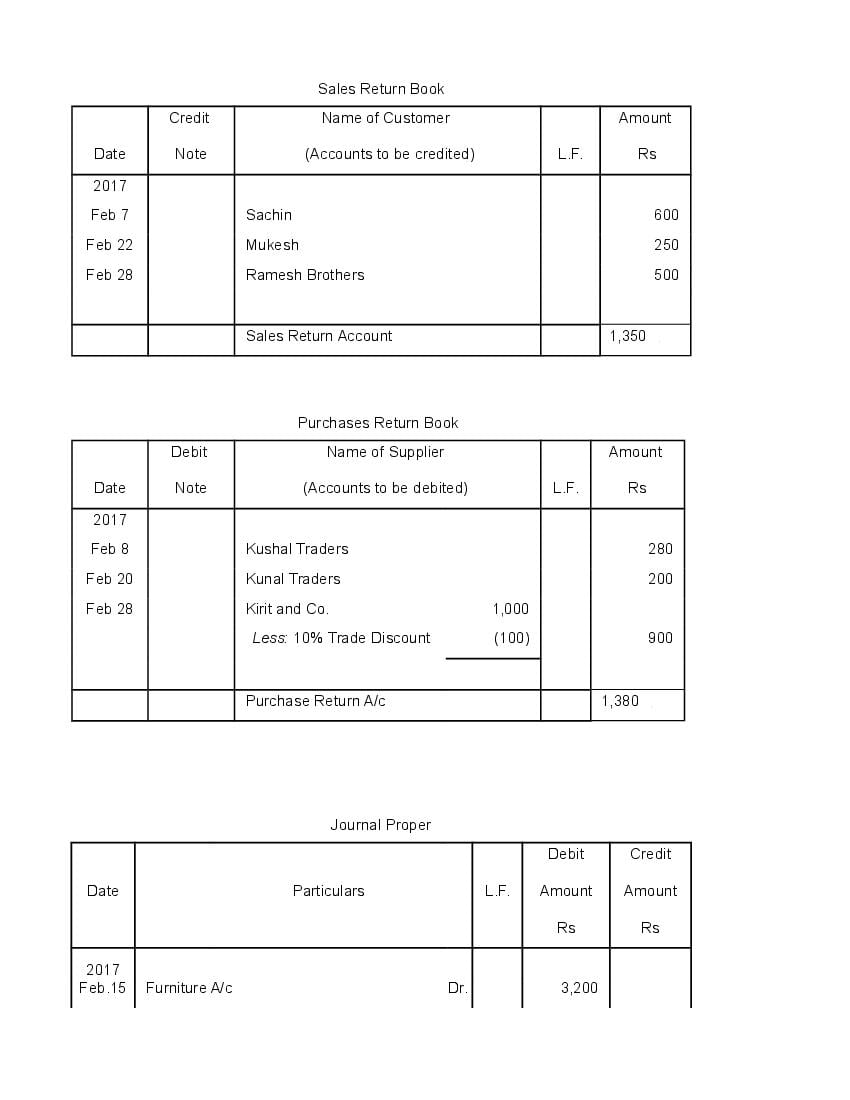

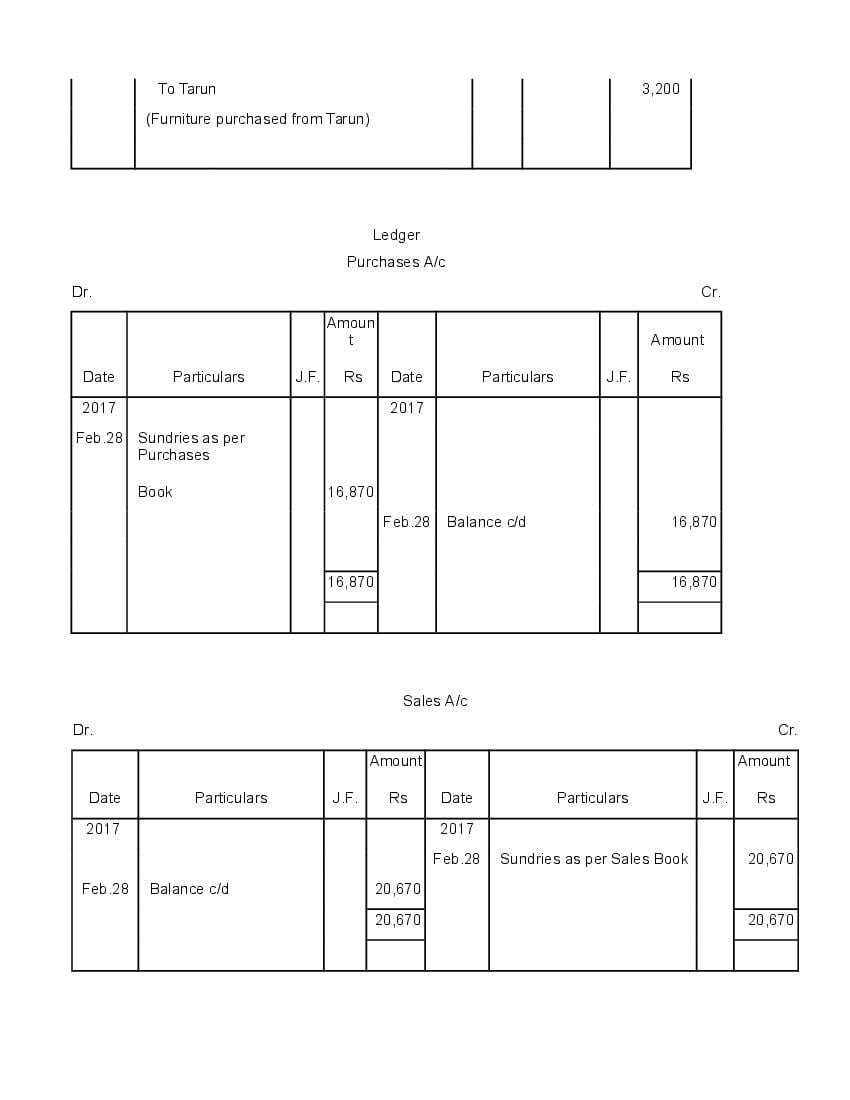

Ans : Business transactions are large in number and difficult to record; so journal is subdivided for quick, efficient and accurate recording or the business transactions. Special purpose books like, sales book and purchases book are maintained for those transactions that are routine and repetitive in nature. Recording through these books is economical and enables division of work among accountants.

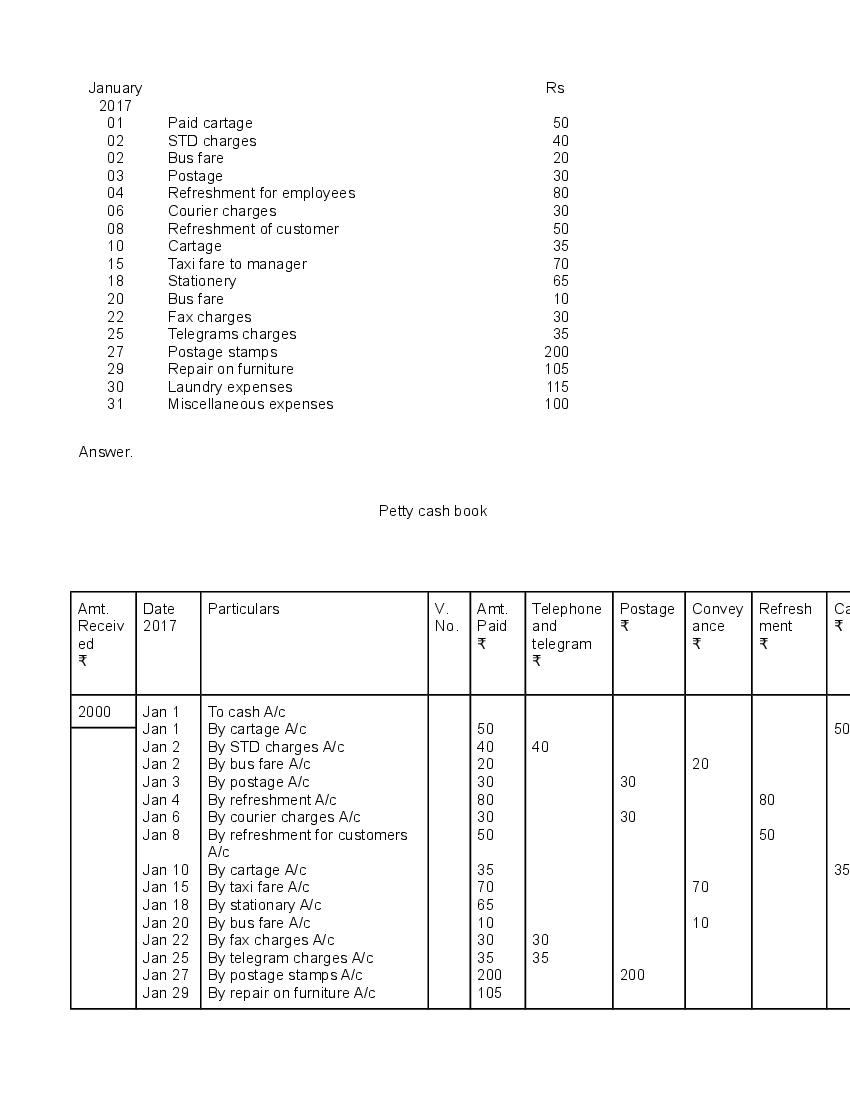

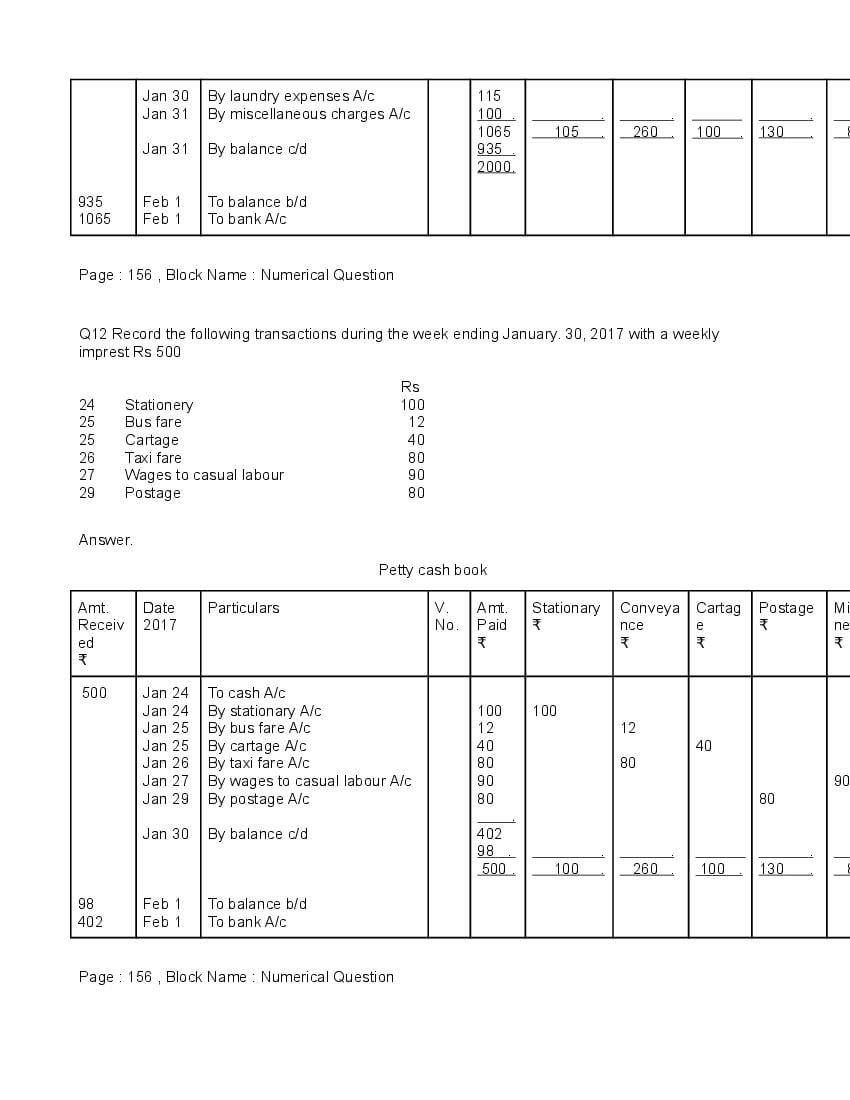

Q.4: What is petty cash book? How it is prepared?

Ans : Petty Cash Book is used for recording payment of petty expenses, which are of smaller denominations like postage, stationery, conveyance, refreshment, etc. Person who maintains petty cash book is known as petty cashier and these small expenses are termed as petty expenses. It is prepared by two methods: Ordinary system: In this case, a fixed sum or money is paid to petty cashier for the payment or petty expenses and after spending the whole amount, the account is submitted by the petty cashier to the main cashier. Imprest system: In this case, a fixed sum ot the money given to the petty cashier in the beginning of a period and at the end of the period the amount spent by him is reimbursed, so that he has a fixed amount in the beginning of every new period.

Q.5: Explain the meaning of posting of journal entries?

Ans : posting is the process of transferring the business transactions from Journal to ledgers. Every transaction is first recorded in the Journal and subsequently transferred to their respective accounts.

NCERT / CBSE Book for Class 11 Accountancy

You can download the NCERT Book for Class 11 Accountancy in PDF format for free. Otherwise you can also buy it easily online.

- Click here for NCERT Book for Class 11 Accountancy

- Click here to buy NCERT Book for Class 11 Accountancy

All NCERT Solutions Class 11

- NCERT Solutions for Class 11 Accountancy

- NCERT Solutions for Class 11 Biology

- NCERT Solutions for Class 11 Chemistry

- NCERT Solutions for Class 11 Maths

- NCERT Solutions for Class 11 Economics

- NCERT Solutions for Class 11 History

- NCERT Solutions for Class 11 Geography

- NCERT Solutions for Class 11 Political Science

- NCERT Solutions for Class 11 Sociology

- NCERT Solutions for Class 11 Psychology

- NCERT Solutions for Class 11 English

- NCERT Solutions for Class 11 Hindi

- NCERT Solutions for Class 11 Physics

- NCERT Solutions for Class 11 Business Studies

- NCERT Solutions for Class 11 Statistics

All NCERT Solutions

You can also check out NCERT Solutions of other classes here. Click on the class number below to go to relevant NCERT Solutions of Class 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12.

| Class 4 | Class 5 | Class 6 |

| Class 7 | Class 8 | Class 9 |

| Class 10 | Class 11 | Class 12 |

Download the NCERT Solutions app for quick access to NCERT Solutions Class 11 Accountancy Chapter 4 Recording of Transactions-II. It will help you stay updated with relevant study material to help you top your class!

The post NCERT Solutions for Class 11 Accountancy Chapter 4 Recording of Transactions II appeared first on AglaSem Schools.

from AglaSem Schools https://ift.tt/3ud5zxZ

https://ift.tt/eA8V8J https://ift.tt/eA8V8J

إرسال تعليق