NCERT Solutions Class 11 Accountancy Chapter 5 Bank Reconciliation Statement – Here are all the NCERT solutions for Class 11 Accountancy Chapter 5. This solution contains questions, answers, images, explanations of the complete chapter 5 titled Bank Reconciliation Statement of Accountancy taught in Class 11. If you are a student of Class 11 who is using NCERT Textbook to study Accountancy, then you must come across chapter 5 Bank Reconciliation Statement. After you have studied lesson, you must be looking for answers of its questions. Here you can get complete NCERT Solutions for Class 11 Accountancy Chapter 5 Bank Reconciliation Statement in one place.

NCERT Solutions Class 11 Accountancy Chapter 5 Bank Reconciliation Statement

Here on AglaSem Schools, you can access to NCERT Book Solutions in free pdf for Accountancy for Class 11 so that you can refer them as and when required. The NCERT Solutions to the questions after every unit of NCERT textbooks aimed at helping students solving difficult questions.

For a better understanding of this chapter, you should also see summary of Chapter 5 Bank Reconciliation Statement , Accountancy, Class 11.

| Class | 11 |

| Subject | Accountancy |

| Book | Financial Accounting Part 1 |

| Chapter Number | 5 |

| Chapter Name |

Bank Reconciliation Statement |

NCERT Solutions Class 11 Accountancy chapter 5 Bank Reconciliation Statement

Class 11, Accountancy chapter 5, Bank Reconciliation Statement solutions are given below in PDF format. You can view them online or download PDF file for future use.

Bank Reconciliation Statement Download

Did you find NCERT Solutions Class 11 Accountancy chapter 5 Bank Reconciliation Statement helpful? If yes, please comment below. Also please like, and share it with your friends!

NCERT Solutions Class 11 Accountancy chapter 5 Bank Reconciliation Statement- Video

You can also watch the video solutions of NCERT Class11 Accountancy chapter 5 Bank Reconciliation Statement here.

Video – will be available soon.

If you liked the video, please subscribe to our YouTube channel so that you can get more such interesting and useful study resources.

Download NCERT Solutions Class 11 Accountancy chapter 5 Bank Reconciliation Statement In PDF Format

You can also download here the NCERT Solutions Class 11 Accountancy chapter 5 Bank Reconciliation Statement in PDF format.

Click Here to download NCERT Solutions for Class 11 Accountancy chapter 5 Bank Reconciliation Statement

Question & Answer

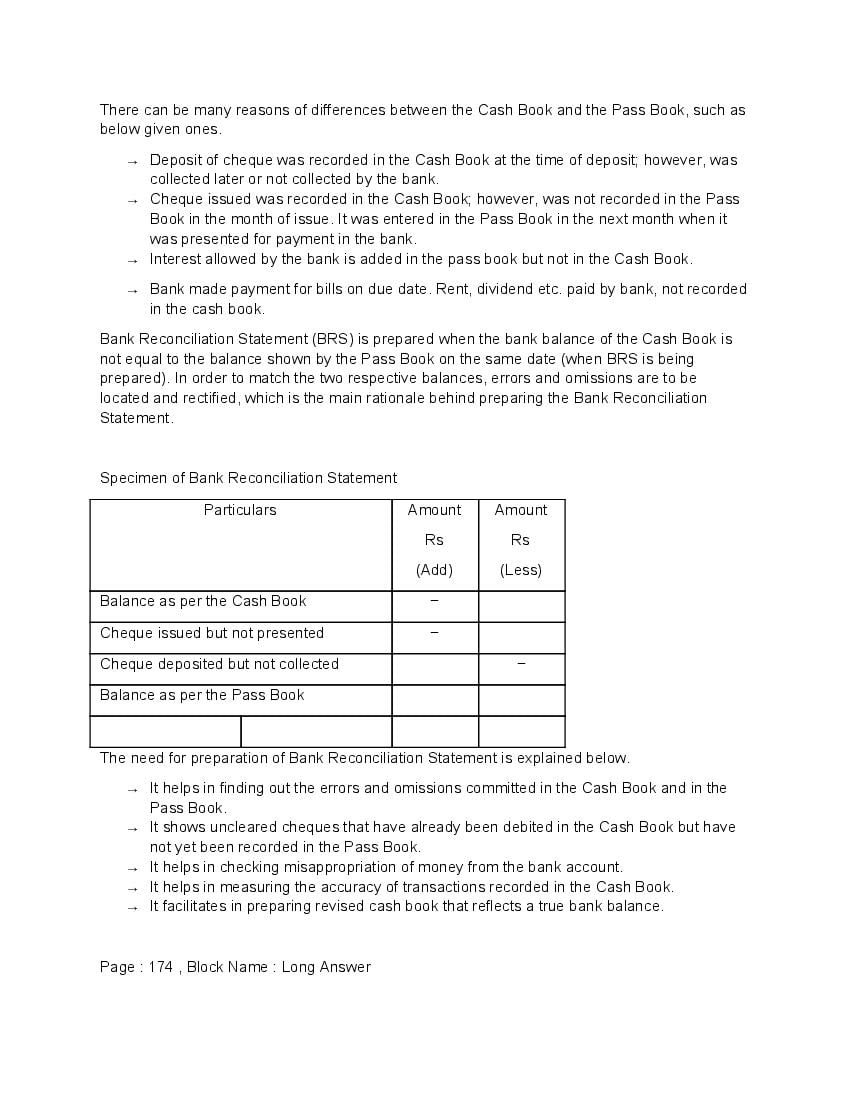

Q.1: State the need for the preparation of bank reconciliation statement?

Ans : The need and importance of the bank reconciliation statement are as follows:

- It ensures accuracy of the balances and records shown by the pass book and cash book.

- It detects the errors which might have occurred in a cash book in connection with bank transactions and helps in rectifying those errors.

- Regular preparation of bank reconciliation statement helps in prevention of frauds.

- It detects any undue delay caused during the recording of transactions or collection of cheques.

- This helps in taking appropriate action to prevent any further delay.

- It keeps a check on the accuracy of entries made in both the books.

- It helps in updating the cash book as per the pass book.

Q.2: What is a bank overdraft?

Ans : When a firm or an account holder withdraws excess amount over the available bank balance, the account, then, runs a negative bank balance. The negative balance is called a bank overdraft. In other words, bank overdraft is the excess of withdrawals over deposits and is considered a liability to an account holder.

Q.3: Briefly explain the statement ‘wrongly debited by the bank’ with the help of an example.

Ans : The statement Wrongly debited by the bank' is alleged when the bank wrongly debits the customers account. A wrong debit reduces the account balance of the customer. Wrong debits occur when a transaction is wrongly recorded or when incorrect amount is debited from an account. Such errors can occur in the following two cases:

- A person has more than one account in a bank: A cheque of Rs.4.OOO issued from his/her savings account was wrongly paid through his/her current account.

- Amounts of cheques are wrongly recorded: A cheque payment of Rs.60,OOO was wrongly debited in the pass book as Rs.6.OOO.

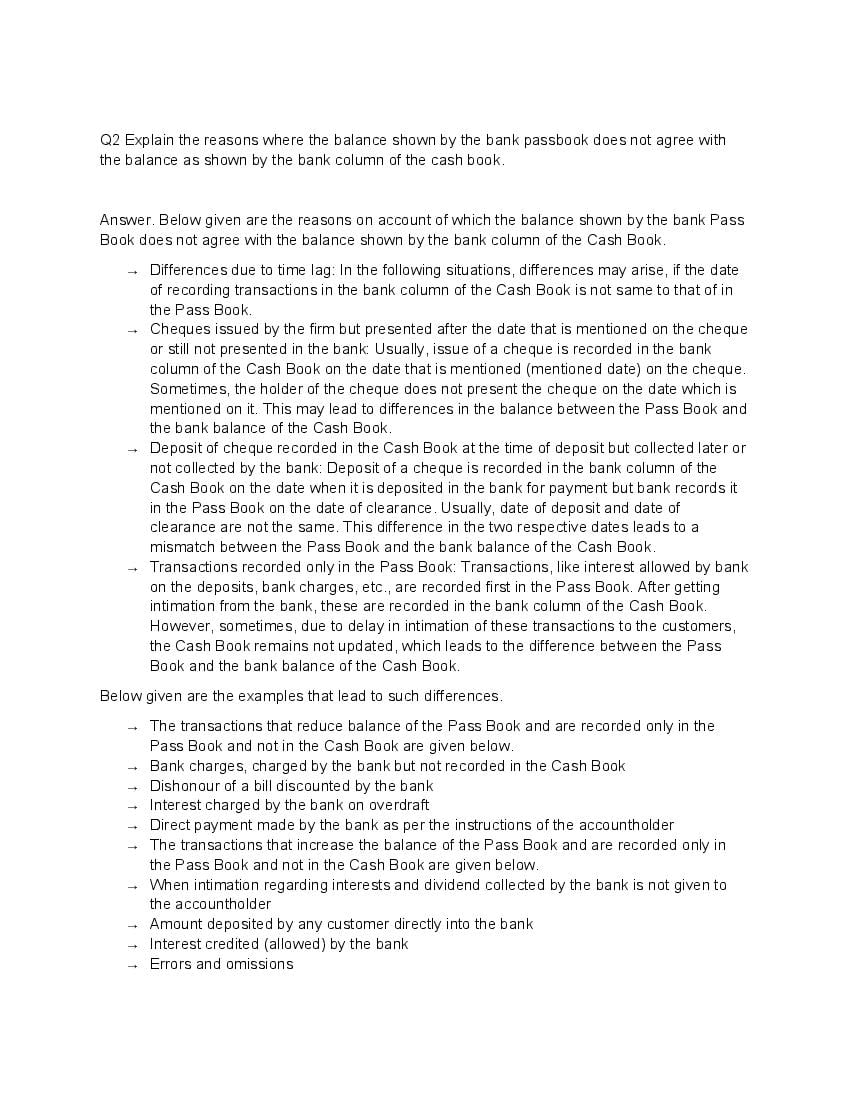

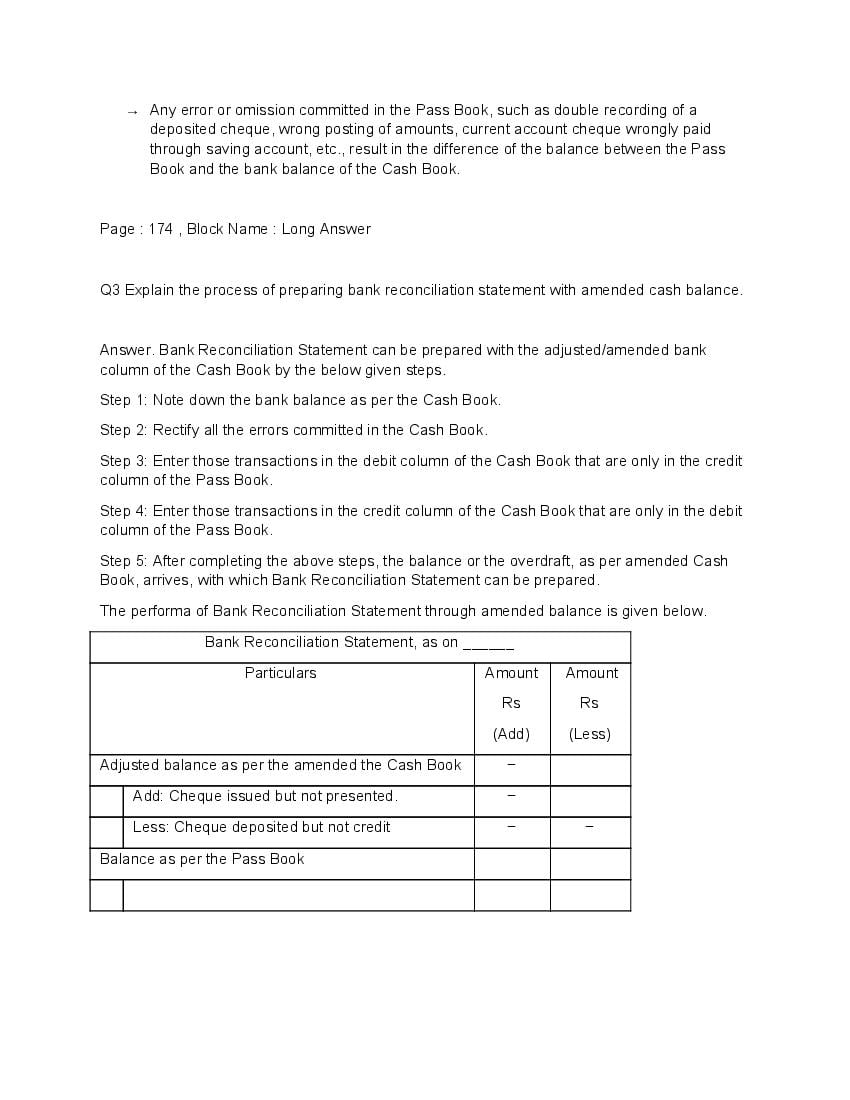

Q.4: State the causes of difference occurred due to time lag.

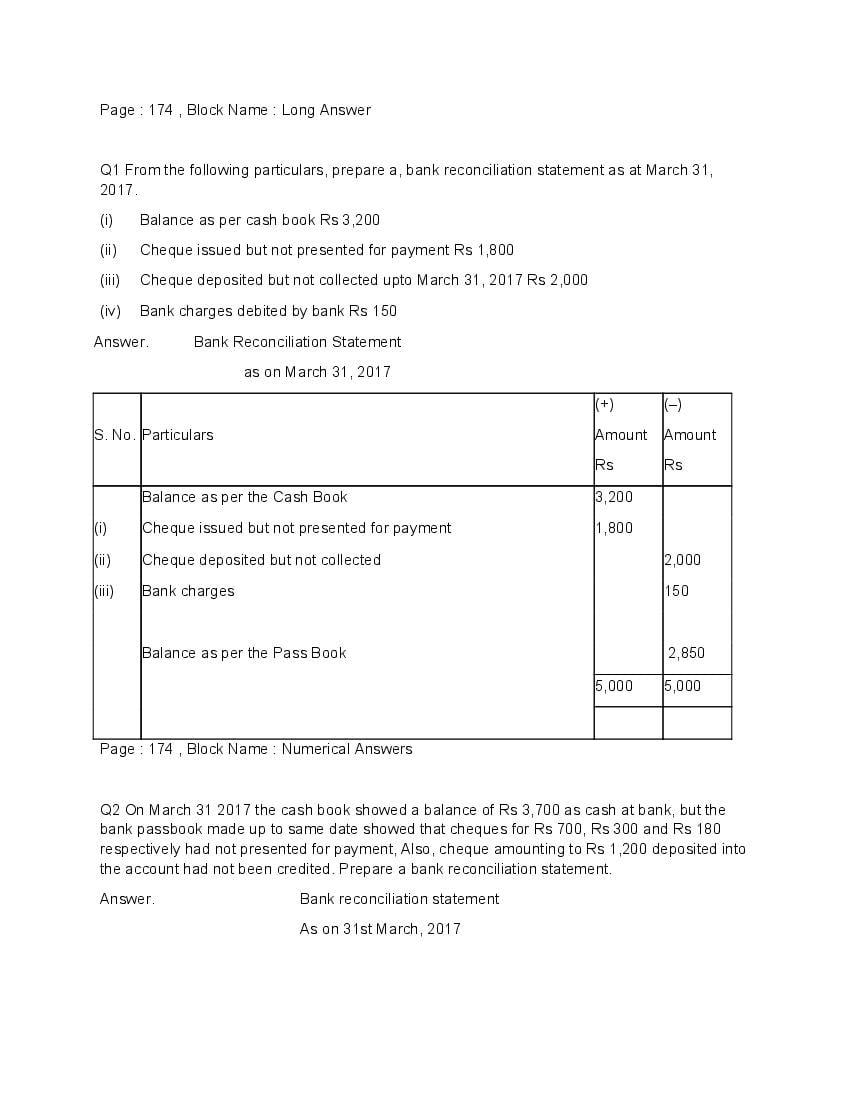

Ans : The causes of difference which occur because of time lag are given below: 1. Cheques issued but not presented for payment at the bank. The firm/customer issues cheques to its suppliers or creditors. But not all these cheques are presented to the bank. The entry in the cash book is made immediately on issue of the cheque but the bank will not pass an entry until the cheque is presented for payment. 2. Cheques paid or deposited but not collected and credited by the bank. Entry is passed by the firm in the cash book when it receives cheques from its debtors which increase the balance as per the cash book. But the bank credits the firm's account only when they have received the payment from the customer's bank or in other words, once the cheque is collected by the bank.

Q.5: Briefly explain the term ‘favourable balance as per cash book’.

Ans : Favourable balance is the excess of total of debit side over total of credit side in a bank column of a cash book. It is also known as debit balance as per the cash book. In other words, favourable balance means excess of deposits over withdrawals.

NCERT / CBSE Book for Class 11 Accountancy

You can download the NCERT Book for Class 11 Accountancy in PDF format for free. Otherwise you can also buy it easily online.

- Click here for NCERT Book for Class 11 Accountancy

- Click here to buy NCERT Book for Class 11 Accountancy

All NCERT Solutions Class 11

- NCERT Solutions for Class 11 Accountancy

- NCERT Solutions for Class 11 Biology

- NCERT Solutions for Class 11 Chemistry

- NCERT Solutions for Class 11 Maths

- NCERT Solutions for Class 11 Economics

- NCERT Solutions for Class 11 History

- NCERT Solutions for Class 11 Geography

- NCERT Solutions for Class 11 Political Science

- NCERT Solutions for Class 11 Sociology

- NCERT Solutions for Class 11 Psychology

- NCERT Solutions for Class 11 English

- NCERT Solutions for Class 11 Hindi

- NCERT Solutions for Class 11 Physics

- NCERT Solutions for Class 11 Business Studies

- NCERT Solutions for Class 11 Statistics

All NCERT Solutions

You can also check out NCERT Solutions of other classes here. Click on the class number below to go to relevant NCERT Solutions of Class 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12.

| Class 4 | Class 5 | Class 6 |

| Class 7 | Class 8 | Class 9 |

| Class 10 | Class 11 | Class 12 |

Download the NCERT Solutions app for quick access to NCERT Solutions Class 11 Accountancy Chapter 5 Bank Reconciliation Statement. It will help you stay updated with relevant study material to help you top your class!

The post NCERT Solutions for Class 11 Accountancy Chapter 5 Bank Reconciliation Statement appeared first on AglaSem Schools.

from AglaSem Schools https://ift.tt/2XPUCVj

https://ift.tt/eA8V8J https://ift.tt/eA8V8J

Post a Comment